Empowering Women in Space Exploration: How E.l.f. Cosmetics is Inspiring the Next Generation of STEM Leaders

The article discusses a new digital film series by e.l.f. Cosmetics that features real female scient

Cameron Lee, Vice President of Rainbow 6, Left Ubisoft

Cameron Lee, a seasoned game development professional, joined the Rainbow Six team at Ubisoft in 202

Saudi Arabia is hosting the inaugural Esports Olympic Games next year

The International Olympic Committee (IOC) has announced the inaugural Olympic Esports Games, to be h

Surprise! Fortnite is getting a new map and mode on Saturday

Fortnite is set to receive a surprise update called "Reload" on Saturday, which will introduce a new

Suda51: “Everyone cares too much about Metacritic scores”

The article discusses the gaming industry's excessive focus on Metacritic scores, which Goichi 'Suda

WWE Money in the Bank 2024 Results: Winners, Live Grades, Reaction and Highlights

The article summarizes the men's Money in the Bank match, which featured a standard ladder match wit

A financially independent investor shares the money advice she’d give her younger self, including 3 mistakes to avoid

Sherry Jiang, the founder of the personal finance platform Peek, shares the money advice she would g

Gonzalez Paiva, Puech Win Doubles Draw First Day of Davidson Invitational

The Longwood men's tennis team had a successful first day at the Davidson Invitational. The duo of M

Blast from the past: Classic and Antique Car Show cruises into Coney Island

The article highlights the third annual Classic and Antique Car Show in Coney Island, where enthusia

Rana Daggubati's Captivating Conversations: A Glimpse into the Lives of Telugu Cinema's Finest

The trailer for Rana Daggubati's new show on Prime Video, "The Rana Daggubati Show," has been releas

25 Stars Who Shop at Costco, Target and Walmart

This article explores the surprising similarities between celebrities and regular people when it com

PlayStation Is Taking ‘Concord’ Offline In Three Days, Issuing Refunds

The article discusses the abrupt end of Concord, a PlayStation and Firewalk game, less than two week![Fan Game ‘Castlevania ReVamped’ Combines Metroidvania and Classic Styles Into One [Trailer]](https://royaweb.us-sea-1.linodeobjects.com/news/image/2024-07/36ec017c89e1e1f81a28276ff4cbfe06.webp)

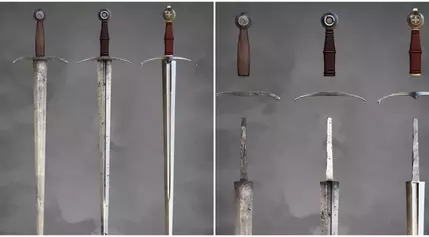

Fan Game ‘Castlevania ReVamped’ Combines Metroidvania and Classic Styles Into One [Trailer]

Castlevania fans are divided between the classic sidescrolling whip action and the Metroidvania styl

Easy Money: Who Benefits - Poor or Wealthy?

This text discusses Puerto Ricans' tax situation and the progressive tax system. It also explores gi

Illinois State Police trooper rescues dogs from burning car after crash on Jane Addams Memorial Tollway

An Illinois State Police trooper heroically rescued two dogs from a burning car after a crash on the

Vigilant Drivers: Safeguarding Valuables and Catching Criminals

The article discusses a series of crimes in Huntsville, Alabama, where a woman broke into a minivan,

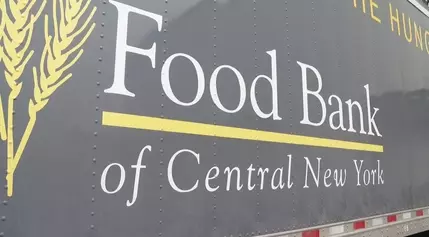

New Food Locker Initiative to Feed Food Insecure Families in Oswego and Cortland

The Food Bank of Central New York introduced food lockers on November 19. Customers can access them

‘I realized that I’m not the only one who has troubles’: Angel Tree kids get scholarship for free camp.

The article discusses the Angel Tree, a prison fellowship program that provides summer camp experien

‘Lift Up Sarpy County’ pantry helps with more than food assistance

The article highlights the growing need for food assistance in Sarpy County, Nebraska, particularly

A car crashed into a Meijer due to a medical emergency in Michigan

In Cascade Township, Michigan on Thursday morning at around 9:30, a car drove into a Meijer. The 29-